Finding A Sustainable Solution

Singapore generally has an efficient and widespread system of healthcare. Singapore was ranked 6th in the World Health Organization’s ranking of the world’s health systems in the year 2010. Singapore has in place a comprehensive healthcare delivery and financing system built on pursuing the following objectives:

- Promote Good Health and Reduce Illness

- Access to Good and Affordable Healthcare

- Pursue Medical Excellence

The government’s healthcare system is based upon the “3M” framework. This has three components:  Medisave, a compulsory health savings scheme that allows practically all Singaporeans to pay for their share of medical treatment without financial difficulty. The second level of protection is provided by Medishield Life, a low cost catastrophic medical insurance scheme. This allows Singaporeans to effectively risk-pool the financial risks of major illnesses and Medifund, which provides a safety net for those who could not otherwise afford healthcare. In 2008, 31.9% of healthcare was funded by the government. It accounts for approximately 3.5% of Singapore’s GDP.

Medisave, a compulsory health savings scheme that allows practically all Singaporeans to pay for their share of medical treatment without financial difficulty. The second level of protection is provided by Medishield Life, a low cost catastrophic medical insurance scheme. This allows Singaporeans to effectively risk-pool the financial risks of major illnesses and Medifund, which provides a safety net for those who could not otherwise afford healthcare. In 2008, 31.9% of healthcare was funded by the government. It accounts for approximately 3.5% of Singapore’s GDP.

Many middle and higher-income Singaporeans have also supplemented their basic coverage with integrated private insurance policies (“Integrated Shield Plans”) for treatment in the private sector. Singaporeans must subscribe to the basic MediShield product before they can purchase the add-on private Integrated Shield Plans.

The current healthcare system has adopted a multi-payers approach and we probably will continue to adopt this system. There is of course other financial funding from the government and charities that rare disease patients can tap on. Therefore, we would like to discuss the reimbursement within our healthcare framework so that you have a better understanding of how each works and how much support a rare disease patient received during hospitalization*:

1. MediShield Life coverage

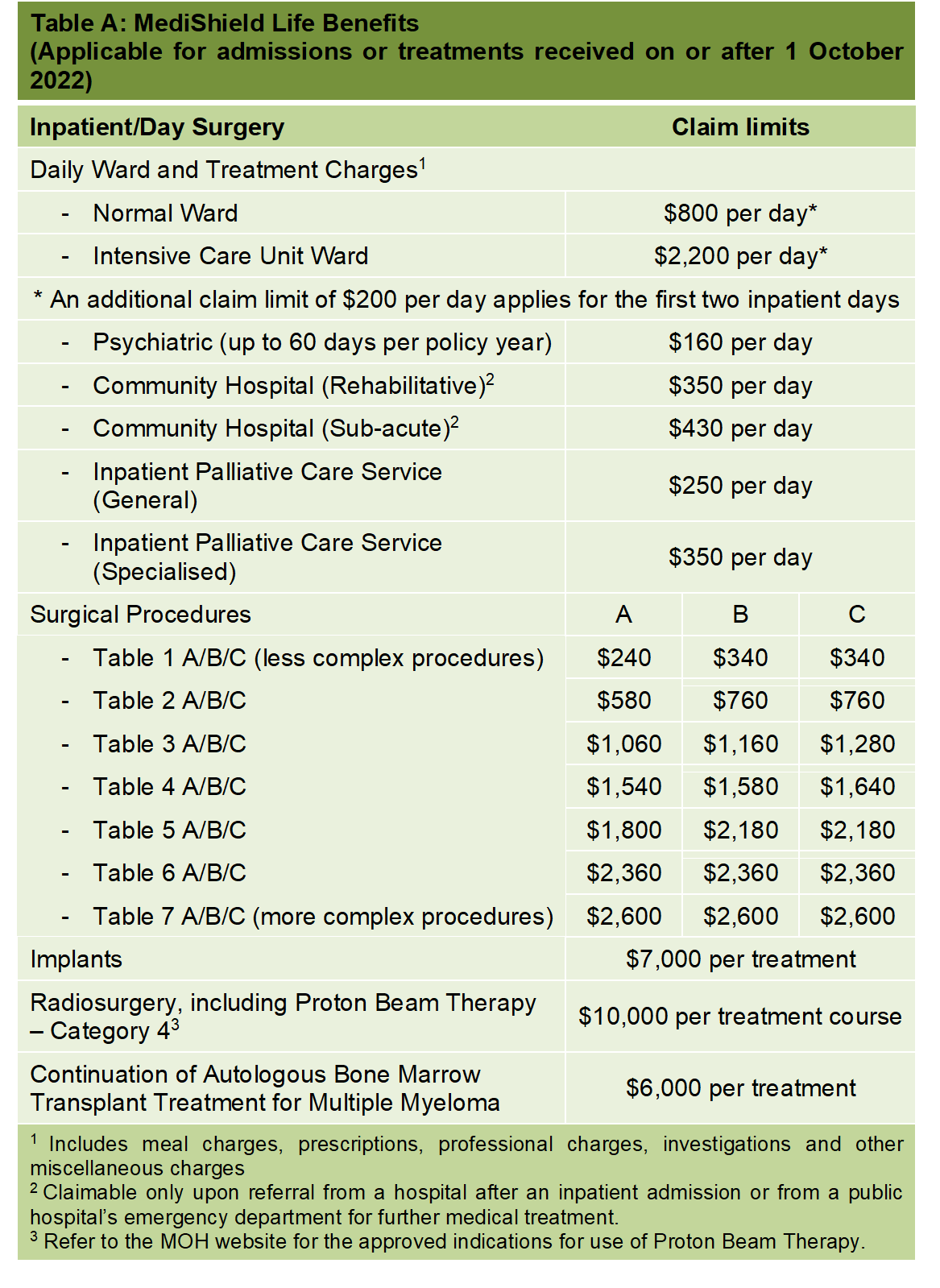

MediShield Life, administered by the Central Provident Fund, offers protection for life for all Singapore Citizens and Permanent Residents, including the very old and those who have pre-existing conditions. The payouts are pegged at B2/C-type wards in public hospitals and will cover a certain portion of your bill. You are still able to choose to stay in a A/B1-type ward or in a private hospital of your choice but then it will only cover only a small proportion of the bill.

Claim limit under Medishield life is $800.00 in the general ward per day. Chloe is admitted only for a day (for her ERT) and her total bill added up to be more than $13,000. As Myozme is not a subsidised standard drug within the SDL (Standard Drug List ), we are unable to receive reimbursement under MediShield Life.

So, it’s not even a 10% coverage… MediShield Life is useful during admission for acute cases where expensive treatment (like ERT) is not required.

2. Medisave

MediSave is a national medical savings scheme that helps individuals set aside part of their income to pay for their personal or approved dependents’ hospitalisation, day surgery and certain outpatient expenses, as well as their healthcare needs in old age.

The inpatient daily hospital limit is set up to $550 for the first two days of admission and $400 per day from the third day onwards for daily hospital charges, in addition to any surgical limit applicable. As parents, we have to reserve MediSave for our own use, my child’s need, and even for our parents’ needs in the event, we are admitted to the hospital.

Since September 2022, there have been changes to the MediSave withdrawal limits for outpatient cancer scans and outpatient chemotherapy treatment too.

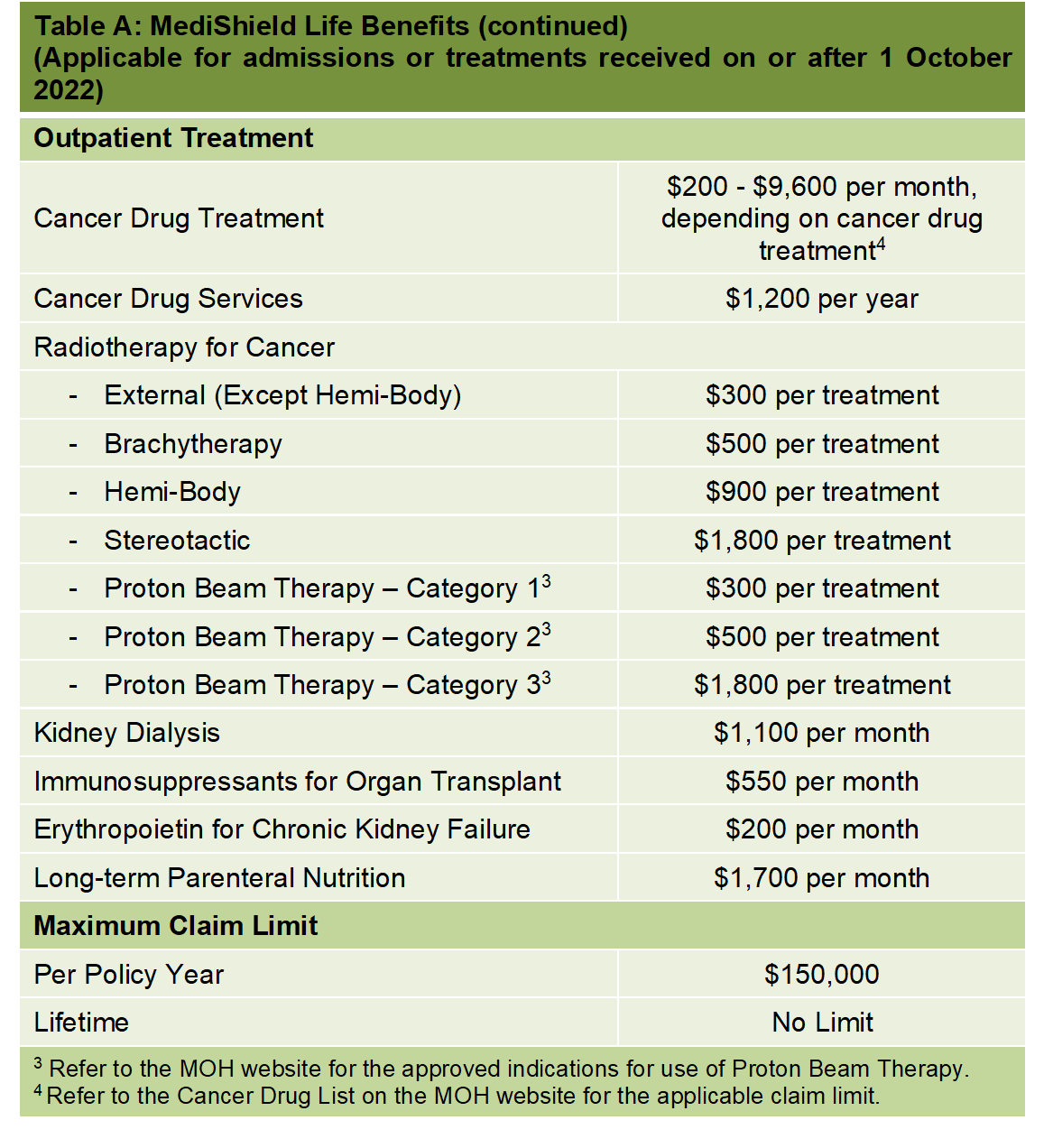

For cancer services such as consultation fees, tests and supportive drugs that treat nausea or infections caused by the treatment, MediShield Life will be raised from $1,200 to $3,600 a year now.

And those who are on IPs will be covered up to a maximum of $18,000 a year, or about $1,500 a month.

3. MediFund

MediFund is an endowment fund set up by the Government. It provides a safety net for patients who face financial difficulties with their remaining bills after receiving Government subsidies and drawing on other means of payment including MediShield Life, MediSave, and cash. MediFund Silver and MediFund Junior are carved out from MediFund to provide more targeted assistance for the needy elderly and the young respectively.

As an endowment fund, interest income generated from the capital sum is allocated to approved healthcare institutions, for them to assist with the medical bill payments of needy patients. Every MediFund-approved institution has an independent MediFund Committee to consider and approve applications, and decide on the appropriate quantum of assistance to provide. The actual amount of assistance you receive depends on you and your family members’ financial , health and social circumstances, as well as the size of the medical bill incurred.

4. MAF Plus (Medication Assistance Fund Plus)

In 2011, the MAF scheme was expanded to the MAF Plus scheme, where instead of a MOH pre-determined drug list, the MAF Plus scheme allows each institution to determine for itself, through a specific set of guidelines and a peer-review mechanism, whether a non-basic drug should be subsidized under the fund.

While MAF Plus is able to help a group of rare disease patients, it may not be enough for all and also, applicants are subject to mean testing.

5. Integrated Shield Plans

If you have an Integrated Shield plan, you will also receive subsidies for the MediShield Life component, if you are eligible. While MedisShield Life covers congenital and pre-existing conditions, they are not exactly covered under the ISPs from your private insurers.

ISP comprises two components:

- MediShield Life component is run by the Central Provident Board (CPF) Board.

- Additional private insurance coverage component run by the insurance company, typically to cover/B1-type wards in public hospitals or private hospitals.

At the moment, Chloe is relying on ISP to cover almost the entire treatment procedure because she was diagnosed after we bought her the ISP. Although there isn’t a daily claim limit at the moment (which we hope remains this way), ISP does have a yearly and lifetime claim limit (depending on the coverage). So what happens if her treatment hit the claim limit? What is there for us?

Recently, the ISP providers are complaining on high pay out and they have since made changes to the policies. Premiums for ISP have since increased by at least 15% and we do not foresee MOH getting involve in setting the premium rate for IPs. They have already stated in their Q&A:

“Integrated Shield Plans (IPs) comprise 2 components – the MediShield Life and the additional private insurance coverage. Similarly, IP premiums have 2 components: a MediShield Life component, and an additional private insurance component.

The Ministry of Health sets the premiums for the MediShield Life component, and provides subsidies to keep MediShield Life premiums affordable. With the increase in MediShield Life premiums, the premiums for the MediShield Life component of IPs will be increased accordingly.

Premiums for the additional private insurance component of IPs are set, reviewed and adjusted by insurers based on commercial and actuarial considerations. Insurers may adjust premiums upwards or downwards taking into account the impact of the MediShield Life benefit changes, their own claims experience, medical inflation and other factors. Insurers have an incentive to keep premiums competitive, to attract and retain policyholders. Singaporeans concerned with the affordability of IP premiums may wish to consider switching to more affordable insurance options, in line with their preferences for hospitalisation coverage.”

Since 2023, ISP will no longer offer “as charged” coverage for some conditions, including cancer. There will be a co-payment where patients have to pay a portion of the medical bills. Previously, we are able to have a “full riders” to cover the whole hospital bill but this has been phased out since 2021. This means that all IP riders will become co-payment riders that require policyholders to pay at least 5% of the hospital bill.

But, the good news is that most insurers have capped the co-payment amount to $3,000 a year (subject to conditions and approval) even though this was not required from the Ministry of Health (MOH).

It seems that ISP providers are taking a motor car insurance approach where “no claim discount” (NCD) will be given while additional premiums will be charged should the insured person made a claim within the coverage period. As ISP is a yearly renewal policy, the insurers are entitled to revise their policy anytime they want. Furthermore, you will find it difficult to switch to another insurer if you have pre-existing condition.

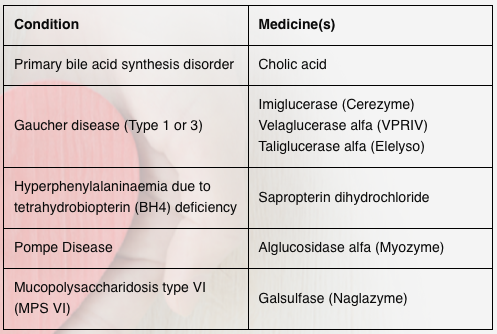

6. Rare Disease Fund

In July 2019, the Ministry of Health (MOH) and the SingHealth Fund have jointly established the Rare Disease Fund (RDF), a charity fund that combines community donations and government matching contributions to support Singapore Citizens with specific rare diseases who require treatment with high-cost medicines. As of Oct 2022, only 6 medicines covering 4 conditions are covered by the RDF. Over time, RDF will be expanded to cover more conditions when more funds are raised.

A voluntary RDF Committee, comprising members from the community, has been set up to approve the list of medicines covered under the RDF, assess patient applications for financial support and exercise stewardship over the Fund.

The RDF Committee is advised by a panel of local clinical specialists with experience in the treatment of rare genetic diseases, who provide expert opinion about which medicines meet the eligibility criteria for inclusion in the RDF.

RDF should be taken as the last line of defense for rare disease patient because it doesn’t function like insurance where small amounts of money is collected from its clients and pools that money together to pay for losses.

7. Crowdfunding

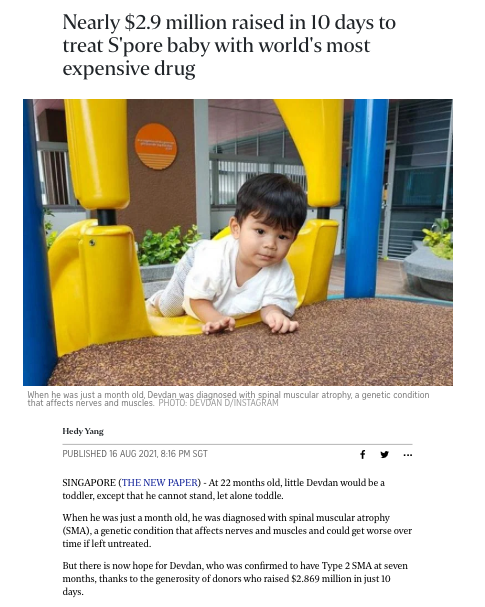

There have been several cases of rare disease patients raising million of dollars via crowdfunding platform to treat their condition. This is happening around the region with more and more patients doing that (especially for patient diagnosed with SMA – Spinal Muscular Atrophy).

Crowdfunding may work for those seeking an one-time treatment (or cure), such as gene therapy. However, it may not serve as a long term solution for those (like Chloe) seeking for lifelong treatment.

What’s happening around our region?

We realized some of the developed countries in the Asia Pacific region have introduced legislation and government funding to take care of patients with rare diseases. Therefore, we believe we should fly the Singapore flag on the rare disease map too.

As parents, we hope all Singaporean will get together behind us to rally for this to happen. What we do today will benefit the next generation because rare diseases can happen to any family. Rare diseases do not recognize race, color, nationality, or social standing…. they could happen to anyone.

We encourage you to read our research (conducted in 2011) on how countries such as Taiwan, Hong Kong, Malaysia, Korea, Japan, and Australia are doing to help Pompe patients and other rare diseases patients. Based on population, the incidence of rare diseases in Singapore will definitely be lower than in other countries.

In 2018, we have seen countries like China, Vietnam, Thailand, Malaysia, and the Philippines introduced funding to help with the medical treatment of their people living with rare disorders. In Malaysia, the funding for treatment was increased from RM10 million to RM16 million recently.

In Australia, the Western Australian Department of Health has developed a state strategy for rare diseases called the WA Rare Diseases Strategic Framework 2015-18 (external site). The National Rare Diseases Working Group convened by the Australian Paediatric Surveillance Unit (APSU) is also preparing a draft for such a nationwide strategy.

In Australia, the Western Australian Department of Health has developed a state strategy for rare diseases called the WA Rare Diseases Strategic Framework 2015-18 (external site). The National Rare Diseases Working Group convened by the Australian Paediatric Surveillance Unit (APSU) is also preparing a draft for such a nationwide strategy.

Such an approach could be helpful for Singapore, to study the short and long-term impact of rare diseases on her constituents, and to also devise strategies that tackle issues of research, clinical practice, and financial sustainability in this area. We are not expecting a complete overhaul of our current system but we could introduce a framework for better caring for people living with rare disorders.

However, there is still more to be done in order to ensure the coverage will last us for life. Please read about it and offer your feedback so that the Ministry of Health could improve on it.

Thank you!

*Above sharing is based on our personal encounters with the payment mechanism within the system. We apologize if any of the facts may not be best explained or represented.

Click the below image to read about our research: